21/22 Canola Harvest Pools Finalisation Results

CBH has finalised and paid out remaining equity for the 2021/22 Canola Harvest Pools.

The final equities* are as follows:

| Grade | Pool | Geraldton | Kwinana | Albany | Esperance |

|---|---|---|---|---|---|

| CAN1 | 1 | $1072.17 | $1070.19 | $1065.11 | $1072.02 |

| CAG1 | 1 | $1032.17 | $1030.19 | $1025.11 | $1032.02 |

*Pool equities are quoted FIS, exclusive of any quality adjustments

| Grade | Pool | Geraldton | Kwinana | Albany | Esperance |

|---|---|---|---|---|---|

| CAN1 | 2 | $1073.27 | $1068.16 | $1063.91 | $1072.95 |

| CAG1 | 2 | $1033.27 | $1028.16 | $1023.91 | $1032.95 |

*Pool equities are quoted FIS, exclusive of any quality adjustments

The Canola Harvest Pools were strongly supported by growers, we thank the pool participants and trust that the pool outcome will be well received.

The results above reinforce the value that pools can bring to a diversified grain marketing portfolio. The No.1 final pool equity represents a historical record for the highest return ever delivered by a CBH Canola pool. The pool return has outperformed the average cash price by $136-181 per tonne and the average harvest price by around $200 per tonne, depending on the zone.

The No.2 pool opened in December 2021 with a pool equity some $115 below the No.1 pool. The final pool outcome was almost on par with the final return in the No.1 Canola Harvest Pool. The pool return has outperformed the average cash price by $135-182 per tonne and the average price by around $200 per tonne, depending on the zone.

The pool results are represented graphically as follows, compared to the best daily price over the period:

No.1 Pool Strategy

The pool management strategy was focused on maximising export sales. With WA’s supply of grains exceeding shipping capacity, it was reasonable to expect some divergence between local prices and international prices over time. The strategy in the No.1 pool was to capture export sale values early, rather than risk this oversupply pressuring achievable values later in the season.

As it turned out, 2021/22 saw high volatility in canola prices. Approaching harvest, the extent of the impact of the drought in Canada on production became clear, supporting international canola prices into the back end of 2021. This led to an accelerated sales pace through harvest as end-users utilised Australian supply to cover shortfalls, which saw the pool tracking towards the upper end of its sales mandate through this period, as intended.

This did mean that the pool was already well sold when markets shifted higher on the back of Russia invading Ukraine, however the pool was still able to capture value on uncovered basis sales and remaining unsold stocks.

No.2 Pool Strategy

International prices were well supported throughout harvest. This was largely due to the drought in Canada which had a severe impact on their canola production, however with significantly increased production in Australia there was an expectation that this uplift in prices could be temporary. It was in this environment that the No.2 pool opened in December 2021 with a pool equity some $115 below the No.1 pool

The No2. pool took all opportunities to execute sales when available in order to maximise early participation in prevailing global values. This selling accelerated through February to April after Russia invaded Ukraine. With significant disruption to sea-borne trade as a result of the conflict, and with Ukraine being a key supplier of oilseed product to the EU, global markets quickly switched their replacement origination to Australia. This proved very supportive of pool equity as global prices shifted sharply higher.

With a pace of sales ahead of that originally anticipated, and in order to continue to participate on sales and maximise the pool’s ability to capitalise on these events, pool management sought an approval to increase the upper bounds of the pool mandate from internal risk committees.

Customer behaviour had shifted to buying further forward than ever before in order to secure supply in an uncertain environment. Although this contributed to the pool committing to sales earlier than anticipated, it retained exposure to market movements by way of maintaining a degree of open basis exposure which was gradually hedged out over the remaining life of the pool.

Logistical Challenges

Whilst the market outcomes this season were beneficial to both the No.1 and No.2 pool equities, there were various logistical challenges over the course of the season which had a material negative impact to the pools. Most ports faced logistical challenges at different times of the year, leading to significant demurrage costs and late contract penalties being incurred. This had a larger impact in certain zones, and due to the materiality of the costs incurred, this has been reflected in the storage and handling charges for those zones.

Currency – No.1 Pool

From a currency perspective, the pool maintained an underhedged position through the harvest period, awaiting opportunities to increase coverage at more favourable levels. The pool accelerated its hedge levels through January and February when both AUDEUR and AUDCAD reached 3-month lows. Both currency pairs then trended higher until April, especially AUDEUR which increased by over 13% to a 5-year high. The pool was well-positioned and was not required to chase material volumes of additional hedging into this upswing, and was able to opportunistically lock away the remainder of the hedging program over the subsequent few months when the currency pairs corrected lower over the middle part of the year.

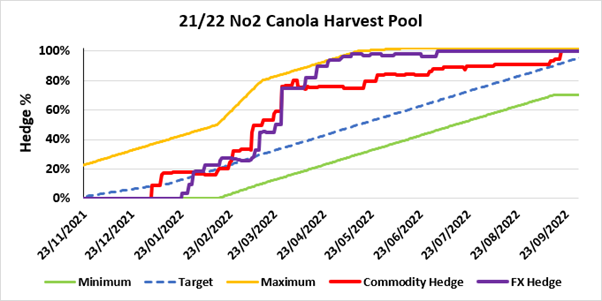

Currency – No.2 Pool

The No.2 pool started hedging in late January when AUDCAD moved towards 2 year lows and AUDEUR approached multi-month lows. Despite both currency pairs then trending higher over February and March, the pool sought to minimise the separation between the commodity and the currency hedge levels given extreme volatility in the market and the values being achieved on commodity hedging. This saw exposures being covered quite rapidly through this period. Whilst both currency pairs then corrected lower from April onwards, a significant portion of the pool had been forward hedged and this correction only added incremental benefit to pool equity over the remaining life of the pool.